Corn

Technicals (May)

May corn futures are fractionally lower in the early morning trade as prices linger near our pivot pocket from 431 1/2-435, which just happens to be right near the middle of first support and first resistance. We like the upside potential in corn but some of the deferred contracts have a more friendly technical landscape than the May.

Bias: Bullish/Neutral

Resistance: 441 3/4-444 1/2, 447 1/2-450*

Pivot: 431 1/2-435

Support: 421-422***

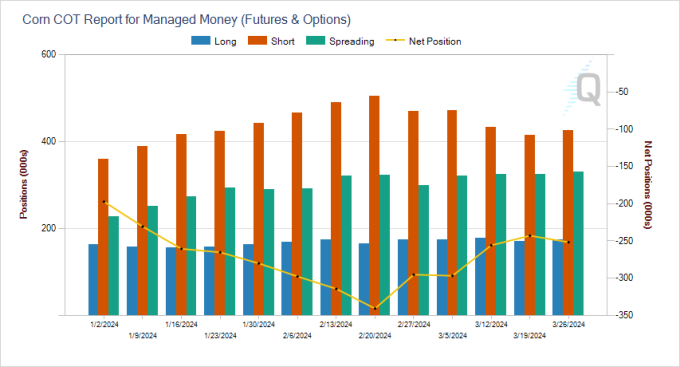

Fund Positioning

Friday’s Commitment of Traders report showed that Funds were net sellers of about 8k contracts (through 4/2/24), that puts their net short position at 259,556.

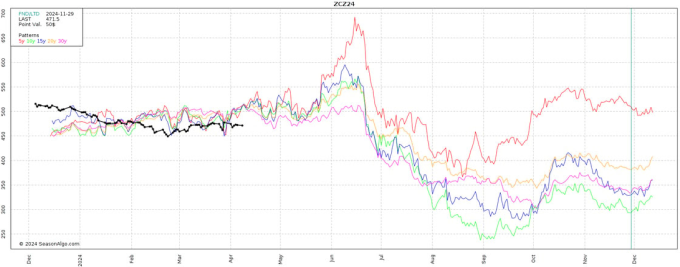

Seasonal Trends

(Past performance is not necessarily indicative of future results)

- Below is a look at price averages for December corn, using the 5, 10, 15, 20, and 30 year averages.

Soybeans

Technicals (May)

May soybean futures are fractionally higher in the early morning trade. Support from 1170-1175 will continue to be very important for the Bulls to defend through this week's trade. A break and close below could spark another wave of pressure. On the resistance side of things, they want to see a close above resistance from 1198-1205 1/2.

Bias: Neutral/Bullish

Resistance: 1198-1205 1/2, 1212 3/4-1216

Pivot: 1187

Support: 1170-1175, 1161-1167*

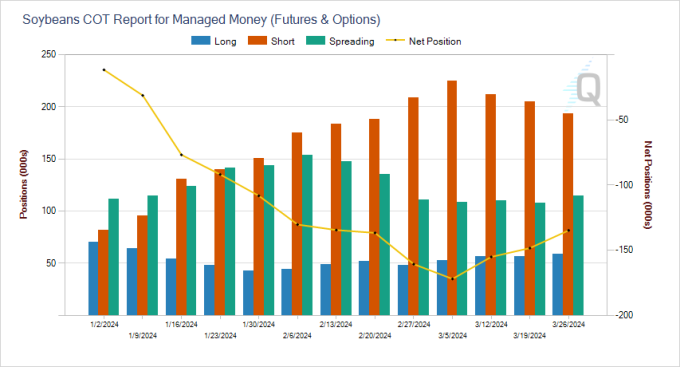

Fund Positioning

Friday's Commitment of Traders report showed Funds were net sellers of roughly 3.5k contracts, trimming their net short position to 138,256 contracts.

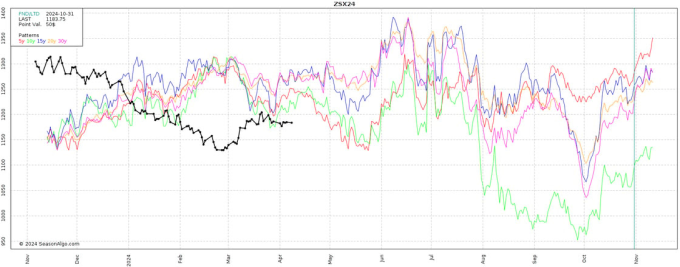

Seasonal Trends

(Past performance is not necessarily indicative of future results)

Below is a look at price averages for November soybeans, using the 5, 10, 15, 20, and 30 year averages.

Continue Reading the full article at: A Quiet Morning in Grain Markets - Blue Line Futures

Contact Oliver Sloup at; 2023 Sign Up - Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.