SpreadEdge Capital specializes in seasonal spread trading across a wide variety of commodity markets. A spread trade is the simultaneous purchase and sale of the same commodity with different delivery dates. SpreadEdge publishes a weekly Newsletter that provides several seasonal spread trade opportunities every week.

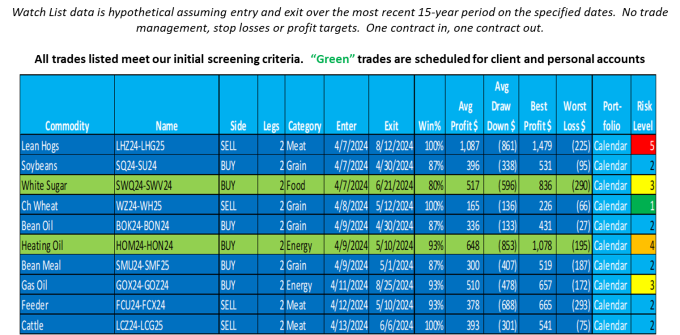

Watch List

The SpreadEdge Newsletter includes a “Watch List” of trades that meet our strict screening criteria. Included in the Watch List are the markets, commodity symbols, entry and exit dates, win %, average profit, average drawdown, best profit, worst loss, and risk level (using a 1-5 scale). All information is hypothetical and is based on the most recent 15 years of historical data.

This week there are 2 trades that are planned for client and personal accounts. This article will focus on the long Heating Oil calendar spread.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Technical Analysis

On a weekly chart, Heating Oil has formed a wedge over the past years that that will very likely break out in one direction or the other. Based on geopolitical risks and the performance of the other Energy markets, I expect the break-out to be to the upside.

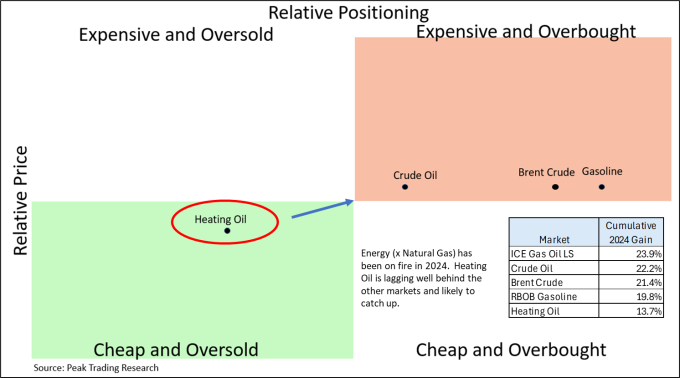

Relative Price and Positioning

Relative Positioning – Oversold versus Overbought on the horizontal axis. COT current net position compared to the COT data over the past 24 months.

Relative Price - Cheap versus Expensive on the vertical axis. A comparison of the front month current price compared to the front month price over the past 24 months.

Heating Oil is currently the only Energy Market (excluding Natural Gas that beats to a different drummer) that is “Cheap and Oversold”. Note that the other markets are currently “Expensive and Overbought”. Looking at the cumulative gain thus far in 2024, Heating Oil is lagging well behind the other markets. Heating Oil has gained less than 14% while the other markets are averaging well over 20%.

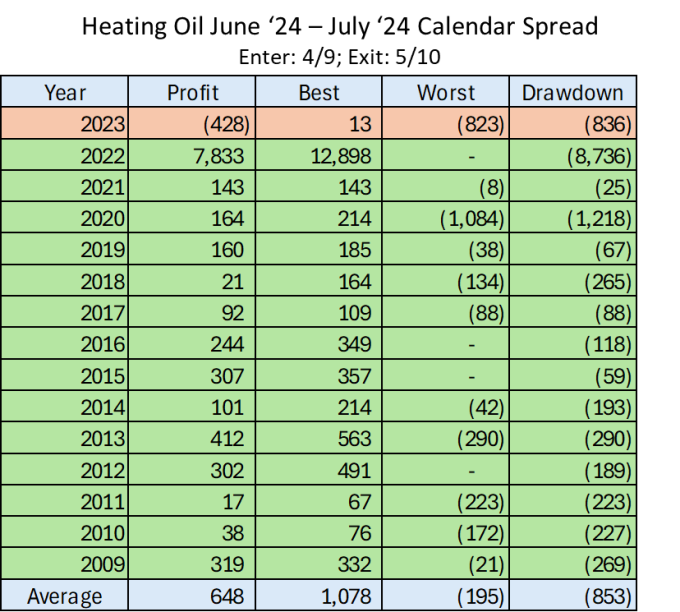

Seasonality

Seasonality data is generated by SeasonAlgo. Entry and exit dates are analyzed and scored for every expiration month combination. Scores are based on a proprietary formula that considers average profit, drawdown and win % over the most recent 15-year period.

Heating Oil is entering a period of seasonal strength. The June, July calendar spread has hypothetically profited in 14 of the past 15 years when entered on 4/9 and exited on 5/10.

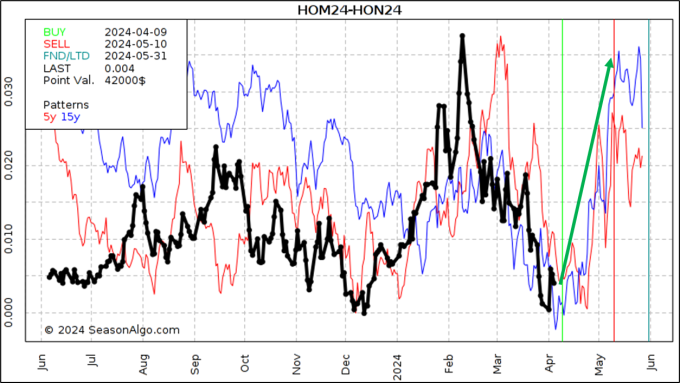

Spread Chart

Spread Charts represent the difference between the front and back month contracts and are simply the front month price minus the back month price. Spreads that are sold profit when the price gets more negative or less positive. Spreads that are bought profit when prices get more positive or less negative.

To trade Heating Oil, I will buy the June, July calendar spread. The optimal entry is Tuesday, April 9 based on the past 15 year of historical data.

Videos

For a video of this trade.

Use coupon code “SpreadEdge” and get the Weekly Newsletter and Daily Alerts for $1 for the first month.

Purchase a 4 video training series with over 3 hours of content.

For a FREE eBook about the SpreadEdge seasonal spread strategy.

More Information

The SpreadEdge Weekly Newsletter is published every weekend and provides a broad overview of the important seasonal, technical, and fundamental indicators within the Energy, Grains, Meats, Softs, Metals and Currency markets. In addition, spread trade recommendations and follow-up on open trades is also provided. For a free copy of the Weekly Newsletter, please send an email to info@SpreadEdgeCapital.com

Darren Carlat

SpreadEdge Capital, LLC

(214) 636-3133

Darren@SpreadEdgeCapital.com

www.SpreadEdgeCapital.com

Disclaimer

SpreadEdge Capital, LLC is registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission and is an NFA member. Past performance is not indicative of future results. Futures trading is not suitable for all investors, The risk associated with futures trading is substantial. Only risk capital should be used for these investments because you can lose more than your original investment. This is not a solicitation.

On the date of publication, Darren Carlat did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.