(KCK24) (RMK24) (CCK24) (CAK24) (ZWN24) (KEN24) (ZSK24) (ZCK24) (CORN) (SOYB) (WEAT) (NGJ24)

“Using the BestWeather Spider to develop commodity market sentiment and trading ideas”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Weekend Report - March 8-10, 2024

N A T U R A L G A S :

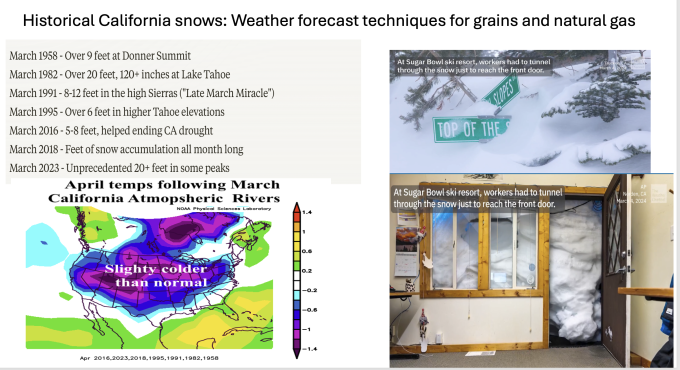

Other than looking at the timing of El Niño transitioning to La Niña, we look at unusual weather events… I coined a term for these phenomena >>> WeatherWeirdos.

The slightly colder late March and April weather conditions could keep natural gas prices from falling very far. Our Weather Spider (A sentiment index for all Ag and Energy commodities in our WeatherWealth newsletter) was “mostly bearish” natural gas since $3.00 !! late last fall - catching part of this big move down in prices. Now, we are more neutral. Notice the temp index becoming slightly more bullish (+1) deeper into March, but nothing extreme.

75% of these years listed above (record western snowfall) had summer bear market in grains.

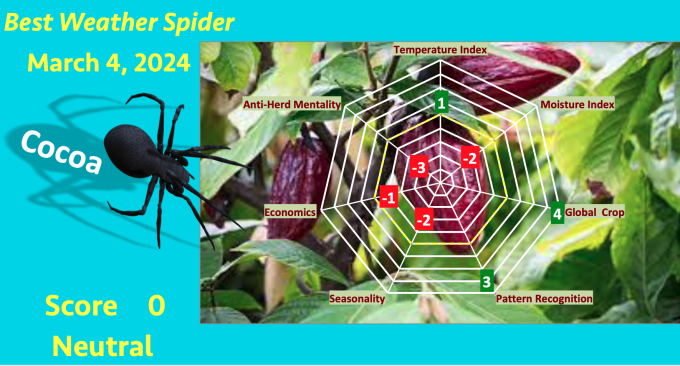

C O C O A :

With respect to cocoa, following a mostly bullish attitude the last 8 months on El Niño and global weather problems, fertilization problems and the third straight year of a global cocoa deficit, our Weather Spider is more neutral right now given improved rainfall coming for west Africa (moisture index slightly bearish -2) vs global crop score very bullish (+4). How do you trade cocoa with options based on El Niño (and if it weakens the next few months)? That is what we do at WeatherWealth. Option strangles may be the way to play this market given such massive volatility.

W H E A T :

We have Weather Spiders and trading strategies all spring and summer long for multiple commodities. For example, the wheat market is quite oversold, but notice the good global crop conditions in almost every country around the world (blue). Will these conditions deteriorate or improve? (Weather Spiders in grains are reserved for clients, subscribers and our inner circle of friends in the trading world).

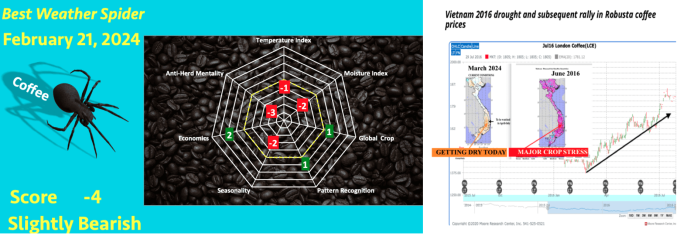

C O F F E E :

Our coffee Spider became bearish again around $1.90 three weeks ago. This is due to generally a big Brazil crop, too big a long spec position (anti-herd mentality is bearish at a -3). However, one concern is a developing drought in Vietnam. The 2016 weakening El Niño analog could portend a potential bull market in Robusta coffee. So… what does a trader do? Trade spreads in coffee, options or futures? Rainfall becomes much more important for Vietnam after April and May. Reservoir levels are extremely low and we will be watching this for our newsletter clients. (It may be a bit too late to sell coffee in the hole).

Download a complimentary issue of WeatherWealth ( a month ago) about the question “Will El Niño transition to La Niña?” and some longer term implications. You can also get a free trial to our newsletter (100 issues a year plus summer grain market updates), often before the crowd reacts, by clicking here >>> https://www.bestweatherinc.com/new-membership-options/

'

Here are some of our newsletter's most recent headline articles:

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. There is no warranty or representation that accounts following any trading program will be profitable.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.