Grain Prices Rally Ahead of USDA Report

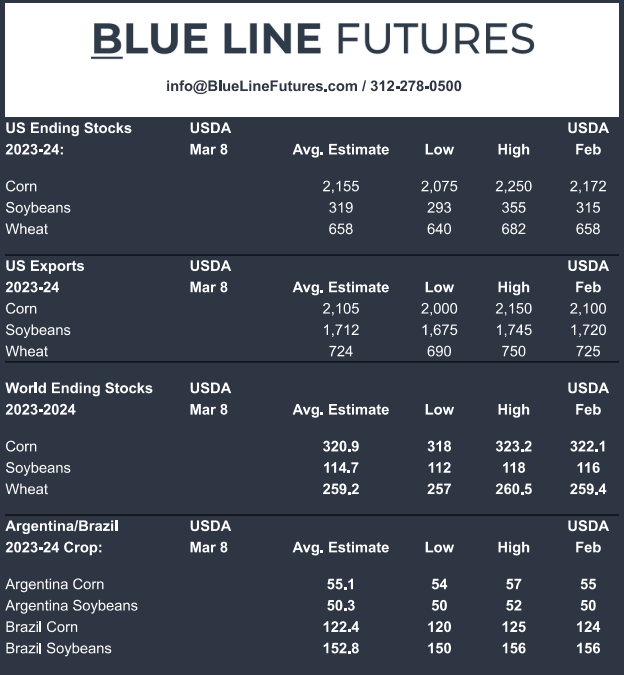

Estimates for today's USDA Report

Corn

Technicals (May)

May corn futures broke out above our pivot pocket from 429 1/2-433 1/4 which accelerated the buying, taking prices as much as 30 cents off the low from February 26th. As mentioned in our yesterday's interview with Chip Flory and AgriTalk, the 20-day moving average seems like such a simple indicator but the fact that everyone was watching it almost made it self-fulfilling. The next upside hurdle comes in from 440-441 with more significant resistance coming in from 447 1/2-450. On the flip side, previous resistance will now act as support (429 1/2-433 1/4).

Bias: Bullish

Resistance: 440-441, 447 1/2-450*

Pivot: 429 1/2-433 1/4

Support: 421-422, 415-416, 398-402**

Fundamental Notes

- Weekly export sales recap: Net sales of 1,109,600 MT (43,683,010 bushels) for 2023/2024 were up 3 percent from the previous week, but unchanged from the prior 4-week average. This was within the range of expectations and similar to the number we saw in last week's report.

- The United States has been losing corn export business to Brazil as the South American country continues expanding its output, though top customer Mexico has secured a record volume of U.S. corn for shipment this year. Mexico’s large chunk of U.S. sales is aided by the fact that China accounts for just 6% of all U.S. corn sales so far, down from about 17% a year ago and about 28% two years ago. Japan’s 14% is above the recent average but below the pre-2021 levels, before China became a big U.S. corn buyer. -Reuters

- The future of U.S.-Mexico corn trade is uncertain as Mexico in recent years has proposed to ban or limit GM corn imports. GM corn accounts for the vast majority of U.S. production, though the lack of alternative options for Mexico has kept market participants’ concerns at bay. -Reuters

Seasonal Tendencies

We put together a more in-depth seasonal analysis article yesterday, zooming in on historical price action leading up to the quarterly stocks and prospective plantings report. Check it out here:

Weekly Seasonal Analysis Update – Blue Line Ag Hedge

Fund Positioning

We took a deeper dive into current Fund positioning and price action and how it compares with 2019. Check it out here:

Are Funds Overextended? – Blue Line Ag Hedge

Check out the full Report at USDA Day! - Blue Line Futures

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.