Are Funds Overextended? – Blue Line Ag Hedge

Are Funds Overextended?

Are funds overextended in their short corn position ahead of key growing seasons for Brazil and the United States? Let’s take a look at how prices responded when Funds were heavily short.

Get all of Blue Line Ag Hedge’s insights, alerts, recommendations, and more delivered to your inbox! Click Here to Learn More!

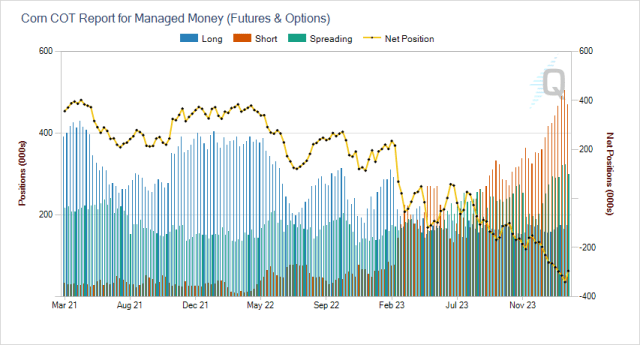

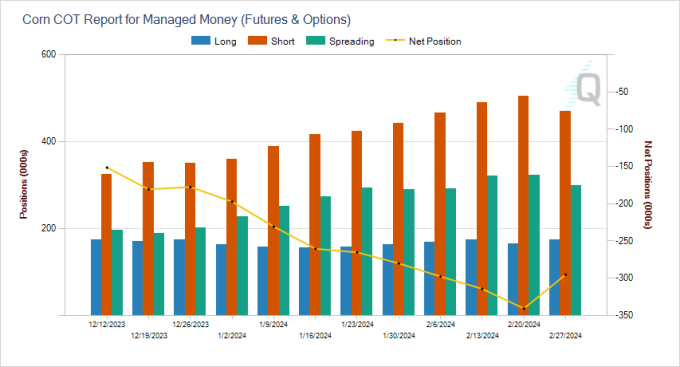

Funds were net buyers of roughly 45k contracts through February 27th, 35.5k of that was short covering as seen in the table below. That ended the eight-week streak of selling from Funds, who still hold a historically large net short position to the tune of 295,258 contracts.

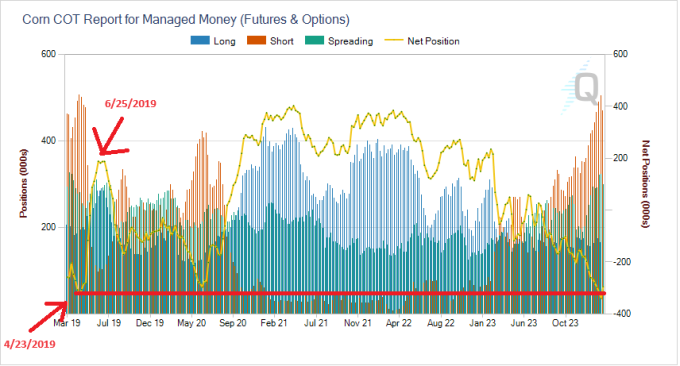

Looking back to the old record short position in 2019 we see funds were short roughly 322k contracts as of 4/23/2019. By June 25th, they flipped to be net long roughly 188k contracts. The rally during that time frame amounted to roughly $1.00 in the futures price. We show you this not to offer false hope, but to remind you that things do change, and they can change on a dime due to either an underlying shift in fundamentals or just a rise in uncertainty. The latter generally set’s up for an opportunity as you can see it did in 2019 where prices eventually set back into the end of 2019 and start of 2020. Having a plan in place with price targets in mind could be more important this year than any of the last 5-years.

Where could this year’s uncertainty come from?

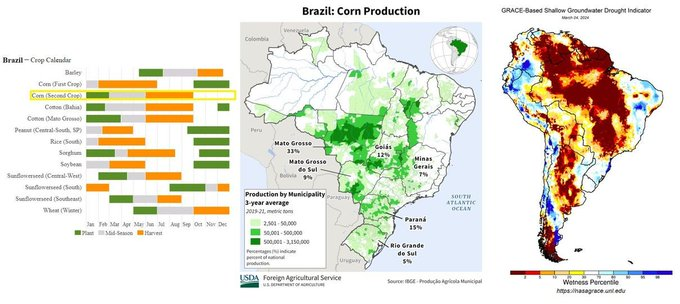

It could come from a lot of different directions, but the one that sticks out to us right now is Brazilian corn production as their second crop could be threatened by drought conditions (see graphic below of Brazilian crop calendar, top producing corn regions, and soil moisture map). The average analyst estimate for Brazilian corn production in this week’s WASDE report comes in at 121.95 MMT. This would be down 2.05 MMT from last month’s report and down sharply from last year’s 137.00 MMT. We will continue working hard to keep clients updated with the latest developments.

Get all of Blue Line Ag Hedge’s insights, alerts, recommendations, and more delivered to your inbox! Click Here to Learn More!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.