In this article

- HSBA-GB

HSBC's full-year 2023 pre-tax profit missed analysts' estimates, hit by impairment costs linked to the London-based lender's stake in a Chinese bank — sinking its shares by as much as 3%.

Europe's largest bank by assets saw its pre-tax profit climb about 78% to $30.3 billion in 2023 from a year ago, according to its statement released Wednesday during the mid-day trading break in Hong Kong. That missed median estimates of $34.06 billion from analysts tracked by LSEG.

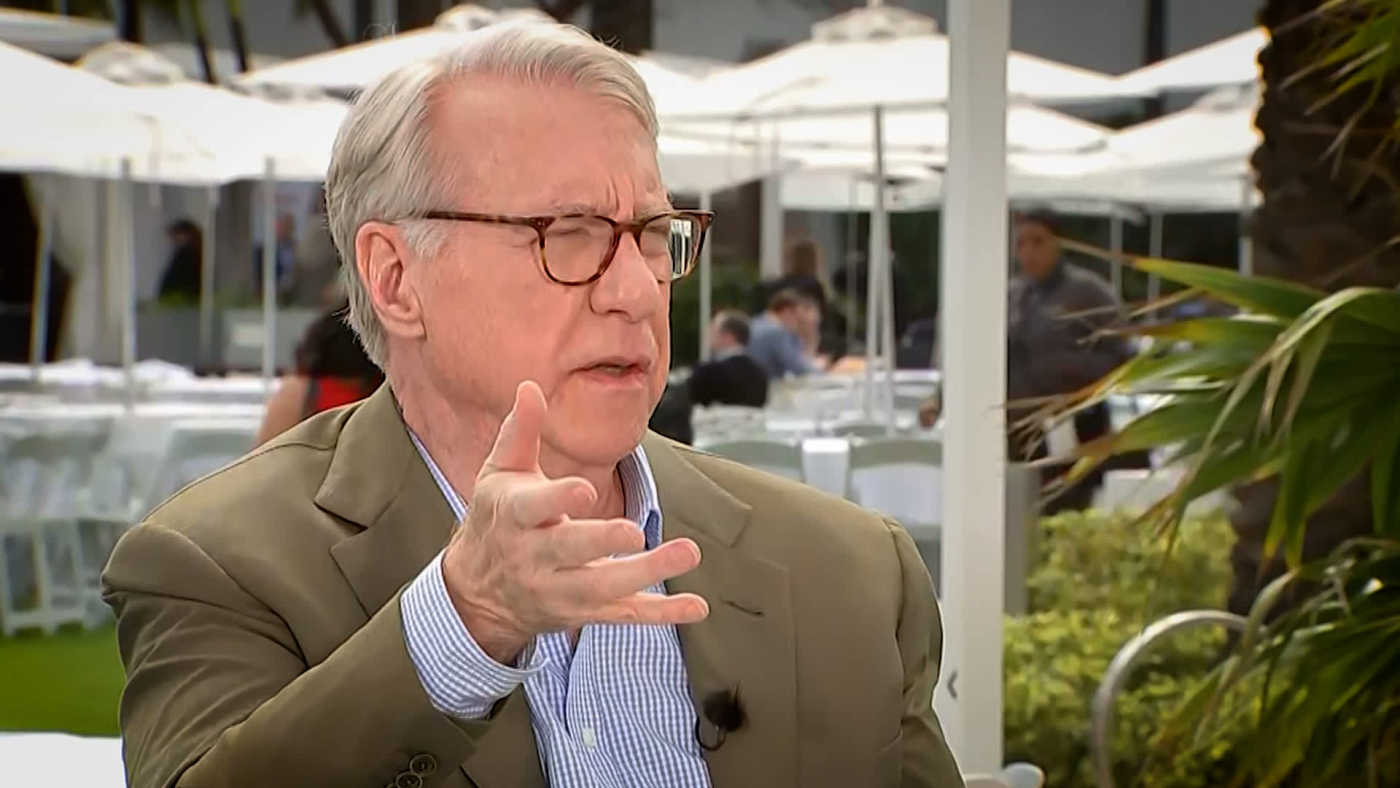

Chief Executive Noel Quinn also announced an additional share buyback of up to $2 billion and the highest full-year dividend per share since 2008. With three share buy-backs in 2023 totaling $7 billion, Quinn said the bank returned $19 billion to shareholders last year.

The bank suffered a "valuation adjustment" of $3 billion on its stake in Bank of Communications, Quinn said.

HSBC's Hong Kong shares reversed gains of about 1% after trading resumed, falling as much as 3.2% in early afternoon trade. The benchmark Hang Seng Index was up nearly 3%.

HSBC shares

HSBC shares

Here are the other highlights of the bank's full year 2023 financial report card:

- Revenue for 2023 increased by 30% to $66.1 billion, compared with the median LSEG forecast for about $66 billion.

- Net interest margin, a measure of lending profitability, was 1.66% — compared with 1.48% in 2022.

- Common equity tier 1 ratio — which measures the bank's capital in relation to its assets — was 14.8%, compared with 14.2% in 2022.

- Basic earnings per share was $1.15, compared with the median LSEG forecast for $1.28 in 2023 and 75 cents for 2022.

This is a developing story. Please check back for more details.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.