Inflation has been one of the hottest personal-finance topics of the past year.

Consumer prices on everything from eggs to cars began to rapidly accelerate in 2021 as a recovering economy ran head-first into hobbled supplies thanks to global logistics issues caused by COVID. It got even worse in 2022, when Russia's invasion of Ukraine—and resultant fuel bans—sent oil prices spiking.

The good news? The Federal Reserve managed to largely beat back this trend with a series of aggressive rate cuts; inflation has retreated close to pre-pandemic levels. (In fact, the United States' inflation rate is lower than most developed countries.)

The bad news? While you were distracted by the rising cost of your bill, you missed the bait-and-switch America's consumer brands were pulling in your grocery cart.

Today, we're going to talk about that bait-and-switch, and what you can do to combat it.

The Tea

The trick up corporate America's sleeve is called shrinkflation.

Whereas inflation is paying more for the same product, shrinkflation is paying the same for less product.

WealthUp Tip: Another way you're getting hit at the register? Junk fees. Here's how to avoid some of these insidious extra costs.

It's hardly new. Studies examining this phenomenon frequently note that shrinkflation really came to prominence in the 1960s and 1970s … in the midst of sky-high inflation.

But why? Let's use a hypothetical (and pretty simplified) example.

Company A produces a 25-ounce package of cookies. Costs like ingredients, employees, machines that make the cookies, shipping, and the grocer's cut all add up to 75¢. Company A sells that package of cookies for $1.00. Company A nets a profit of 25¢.

Over the course of a year, costs for flour and sugar go up. So too do employee wages. So do gas costs, so shipping costs more. Suddenly, the cost to produce a package of cookies is $1.00. If Company A wants to maintain their 25¢ profit, the most natural thing to do is to raise the price to $1.25.

That right there is how inflation works its way through the system, with the company directly passing on increasing costs as increased prices to the consumer.

But even if you gradually increase prices, shoppers tend to notice. They remember what they buy every week, and they're attuned to what it costs. And at a certain point, consumers change their behavior, whether that's comparing brands, buying less, or for less-necessary goods, cutting things out altogether.

Enter shrinkflation.

Company A noticed that after its last price increase, some customers said "No cookies for me!" But their costs are still going up … so how can they keep their profits aloft? "Well," someone suggests, "why don't we keep the price flat, but put fewer cookies in a package?"

Ingenious! Company A saves a few cents per package in costs, so despite keeping the selling price flat, they're netting a bigger profit.

You might be asking yourself, "Won't people notice they're getting less?" Well, they do … eventually … sometimes. But not nearly as often or as quickly as they notice rising prices.

And companies have gotten awfully creative about masking this practice. From the Federal Reserve Bank of St. Louis:

"In some cases, the size and shape of containers are changed, which camouflages any reduction in the amount of a product. For example, a business might use a taller and thinner container that looks similar but holds less product: The 32-ounce Gatorade bottle was redesigned to a more aerodynamic 28-ounce size, but the price remained the same. Or have you noticed that little dimple on the bottom of jars of peanut butter? A slightly larger dimple means slightly less peanut butter in the jar, but most consumers do not notice the change."

(Editor's note: I didn't know about the peanut butter dimple until I wrote this letter. I actually screamed this up to my wife as I read it, prompting her to shut the basement door. Which, fair.)

WealthUp Tip: A lot of us get tricked into paying more without even knowing. And it happens bit by bit. Here's how.

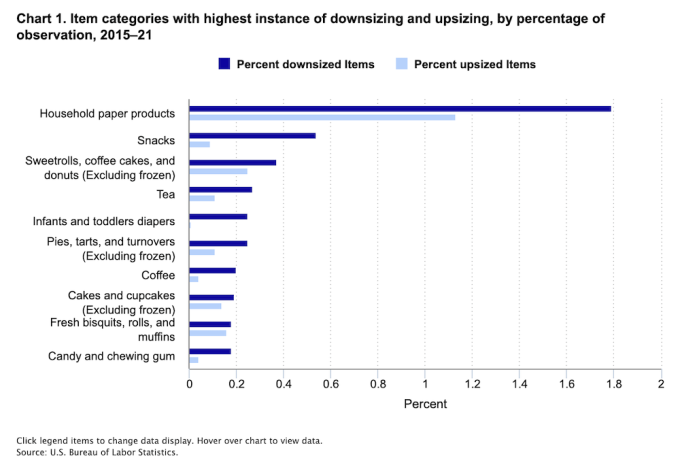

Shrinkflation can happen virtually anywhere, but certain products are more prone than others. You can check out our latest list of 14 commonly bought products affected by shrinkflation to see specifically where you're getting the short end of the butter stick nowadays. But here's a look at data from the Bureau of Labor Statistics (BLS) showing where shrinkflation has been most prominent in recent times:

Shrinkflation is so prevalent nowadays, it has even caught the White House's attention. In a video posted on Super Bowl Sunday, President Joe Biden called out companies for practicing shrinkflation and said it needs to stop.

"Hey," you interrupt. (Rude!) "Shrinkflation still means I'm paying more for what I get. Isn't that inflation?"

You're right! And in fact, the BLS has long accounted for shrinkflation when calculating the U.S. Consumer Price Index (CPI). From the Bureau:

"Data collectors collect prices for the same unique set of goods and services over time. This includes identifying, verifying, and notifying each other of product size changes so the effective price change experienced by consumers can be accurately reflected in the CPI. When an item goes through downsizing or upsizing, the data collector reports the new data, updates the product description, and sends a message to economists in the national program office noting the product size change.

"Data collectors do not record information such as the number of chocolate chips in a cookie or the number of pepperonis on a pizza; however, they do record attributes such as weight and volume."

The Take

So … you still have to eat, wash your hair, and wipe your butt. Can you do anything to counter the effects of shrinkflation?

Yes, though to be brutally honest, you'll never fully escape inflation or shrinkflation.

It's worth noting, if only for your own psychological well-being, that most of us notice inflation, and even shrinkflation, a lot more than our own rising wages. In fact, wage growth has actually outpaced inflation between January 2021 to October 2023—a period that includes the aforementioned spike in prices (h/t Fortune).

WealthUp Tip: Looking to secure your employment future? Here are 20 of the fastest-growing occupations in America.

Of course, that doesn't mean anything if your own personal wages didn't outstrip inflation. It certainly doesn't put more food on your table.

So if you want to fight back against shrinkflation and get a little more bang out of your grocery dollar, here are a few tips from WealthUp Staff Writer Hannah Kowalczyk-Harper:

Be Wary of Package Redesigns

Sometimes, brands redesign packages just to give them a fresher look and make sure you notice them in the grocery-store aisle. But sometimes they purposely redesign products to make shrinkage less obvious.

If a brand you buy undergoes a redesign, that's a great time to check to see whether the amount of product is the same. You probably don't have product weight memorized, of course. But if you shop on websites or a store app, you can look at past purchases to see whether the amount listed on the old packaging is the same or less.

Getting less? Vote with your dollars by buying less or purchasing a competitor's product instead.

Compare Prices

Your current brand choice might not necessarily be the most affordable option—even if you opt for generic products! Check out price labels to see how many ounces, pounds, milliliters, etc., you're getting per unit. This is the easiest way to directly compare which product is giving you the better deal.

Interestingly, buying a product in bulk doesn't always save you money, so it's worth comparing different sizes of the same product as well.

Switch to Reusables

Toilet paper prices stressing you out? Consider switching to a bidet to reduce how much toilet paper you need to buy. Yes, you might have to pay more upfront, but it should save you money over time.

WealthUp Tip: Have you ever heard of the "pink tax"? Half of the country pays it … and there are ways around it.

For less extreme methods, consider that paper towels can be switched out for reusable washcloths, and single-use water bottles can be subbed out for reusable ones. (If you're worried about water taste, you can even get water bottles with built-in filters.) And in many cases, reusables don't just save money on groceries—they're better for the planet, too.

Let Them Know

It doesn't hurt to reach out directly to your favorite brands when you've noticed that either package sizes have declined or prices have risen too much. While all brands aren't necessarily responsive, some can be ... and the more comments they receive, the better.

Riley & Kyle

WealthUp (Young and the Invested is now WealthUp)

Like what you're reading but not yet a subscriber? Get our weekly financial insights and updates delivered to your inbox every Saturday morning by signing up for The Weekend Tea today! You can also follow WealthUp on Flipboard for more great advice and insights.

On the date of publication, Kyle Woodley did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.